CFO & Advisory Services

Our advisory services center around financial planning and analysis and are aimed at helping you make informed, well thought out decisions. Our analytical methods help you make sense of the complex. These services are customized to meet the unique challenges of each business and can be a one off special project or ongoing in nature. Many of these advisory services are most powerful if layered on top of our regular bookkeeping services because we are already entrenched in the finances of your business and know the data we are working with is reliable. We of course welcome the opportunity to help non-bookkeeping clients as well, it just might add a bit of ground work.

Below we provide an overview of some of our primary advisor offerings. Many services overlap or pair with one another and are highly customizable. The descriptions are meant to outline some of our capabilities rather than serve as a complete menu of options. If you’re dealing with a business or financial challenge we invite you to book a free call to explore whether we are the best option to help you navigate it.

Service Offerings

Forecasting

We create financial projections for revenue, profitability, and cash flow. We utilize historic trends, current market data, input from the business owner, and a thorough understanding of the economics of the business to help anchor our projections. Forecasting often involves some form of scenario analysis (i.e. what if sales decline 10%, what if fuel costs go up 25%, etc.). Use cases can vary widely, but generally forecasts can help a business owner anticipate and plan for what’s might be coming rather than reacting chaotically. It can help determine whether capacity levels need to be increased, how much inventory should be carried, what level of working capital needs to be maintained, etc.

Budgeting

We dive into the key drivers of the business’s profitability to reveal which actions management can take to achieve desired results. This can involve scenario analysis such as the effects of altering volume/margin. It also often involves ongoing tracking of budget vs actuals and can dovetail nicely with KPI (key performance indicator) tracking and analysis.

Cash Flow Management

Cash is the life blood of a business and managing it well can play a huge roll in the success and profitability of a company. Many solid businesses have failed due to poor cash flow management. This service often pairs or incorporates some aspects of forecasting and helps a business owner understand how much cash is available and the timing of it. Can a new piece of equipment be financed internally or is a loan needed? How much inventory can we afford to purchase and when? For seasonal businesses, how much cash do we need to make it through the off season? How much can a business owner pay themselves? Can we earn interest on working capital? These are just some of the questions we help businesses answer.

Capital Investment

Your business is growing or you’ve identified a great new opportunity to expand! That’s great but, it’s probably going to require some upfront investment. Is it worth it? We can help you navigate these types of decisions through financial projects and return on investment type analysis. We can also help you determine if you can/should finance the investment yourself or should seek external funding and help you evaluate the cost of each option.

Acquisitions/

Divestitures

Looking to buy or sell whole businesses or chunks of businesses? We can help you navigate that. The acquisition side looks a lot like our services for analyzing capital investments just usually more extensive and detailed. It typically involves profitability analysis, financial projections, and return on investment analysis as well as an examination of financing options. If you’re looking to sell, we can help you prepare for that by identifying ways to make your business or assets as attractive as possible as well as compile financial and company data in a way that can be presented to potential buyers.

Pricing

Our advisory services vary greatly in price and are very customized for the complexity and scope of the engagement. While some can be added to monthly bookkeeping for a relatively small fee, most services and projects range from $500 to a few thousand. Booking a call to explore options is free.

Get In Touch

Email: [email protected]

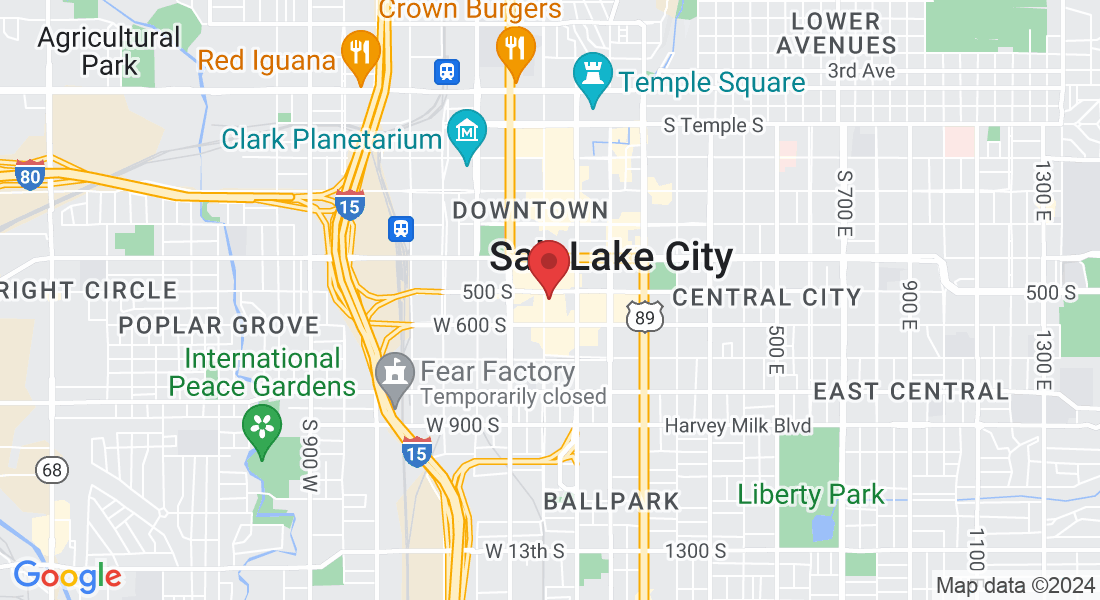

Address : 517 South 200 West

Phone: (385) 483-5221

Assistance Hours :

Mon – Fri 8:00am - 6:00pm